By Gina Roos, editor-in-chief

Taiwanese startup INT Tech. , an asset-light advanced technology company, recently debuted its first product, an ultra-high pixel density display (UHPD) platform that will significantly improve the user’s visual experience. The UHPD platform is a proprietary glass-based red/green/blue (RGB) AMOLED display that delivers the industry’s highest pixel density at >2,200 ppi. This enables realism in displays of all sizes and makes them suitable for a range of applications such as virtual reality/augmented reality (VR/AR) headsets as well as more visually demanding robotic surgical devices, military, and industrial head-mounted displays (HMDs).

INT also introduced its smart pixel and IC (SPIC) platform. The board-level solution supports the integration of multiple sensors, including fingerprint, eye tracking, ambient light, and proximity, on the same backplane as the display. “SPIC allows designers to make an entire display into a live sensing area,” said the company.

The SPIC platform enables a larger sensing area, which can be as large as the whole display because the sensors are developed on the glass or flexible substrate or integrated on the backplane. In comparison, silicon-based displays, which require a separate layer for the sensors, increase thickness while limiting potential active sensing areas, said INT. In addition, glass or flexible substrate-based sensors can be developed in flat panel fabs and manufactured at a much lower cost than silicon-based sensors.

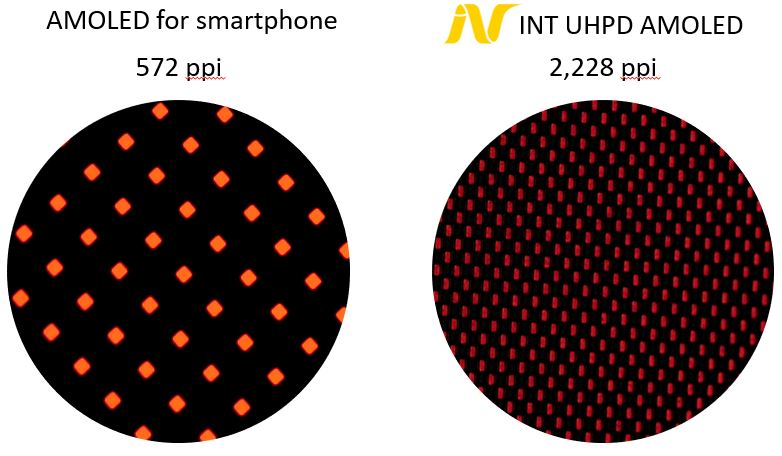

Direct comparison of pixel density in INT Tech’s UHPD AMOLED vs. commercially available AMOLED in smartphones at the same magnification. (Image: INT Tech)

Three advantages:

- Highest ppi on glass — The 2,228-ppi demo display sets a new pixel-density standard, eliminates screen door effect, and dramatically increases image sharpness.

- Larger field of view (FOV) — The glass-based display can be made much larger than silicon-based OLEDs.

- Smart pixel and IC (SPIC) technology — The proprietary SPIC technology enables the integration of multiple sensors on the same backplane as the display. Based on a thin-film transistor (TFT) process and developed on a glass or flexible substrate, SPIC is suited for internet of things (IoT) and biosensor applications.

The UHPD AMOLED display is built on INT’s proprietary sub-micron TFT process that offers a small pixel size and a much larger aperture ratio. It also eliminates the “screen door effect,” wherein the lines separating the pixels are visible, and increases image sharpness.

One of the overriding goals of the company is to develop key technologies that enable the 5G era. Currently, it has three technology platforms to support the market: UHPD, SPIC, and O’flex, a foldable or flexible electronics technology. However, the company’s initial focus is on UHPD display technology as it strengthens its partner relationships through joint development, customized design and sampling, and migration to mass production.

“When 5G arrives, people will no longer be satisfied with 2D images and video,” said David Chu, Ph.D., chairman and CEO, INT. “This will drive new opportunities in VR, and it is a big reason why we are targeting this fast-evolving space as we introduce our first technologies to market.”

“INT’s UHPD is especially well-suited to VR and AR because it eliminates the screen door effect that has plagued users,” added Chu. “At the same time, it provides exceptionally immersive user experiences. More importantly, this technology can dramatically improve the image quality of visually demanding applications such as robotic surgical systems, military HMDs, and other specialized industrial applications.”

INT’s 2,200-plus-ppi display is the highest ppi ever achieved on glass, said Sun Ling, INT’s director of business development. “Currently, the highest pixel density for commercial mobile phone AMOLEDs is 572 ppi, and the yield is low when approaching 800+ ppi. We have 4× more pixels in unit area, and the difference is dramatic. We also have a large field of view.”

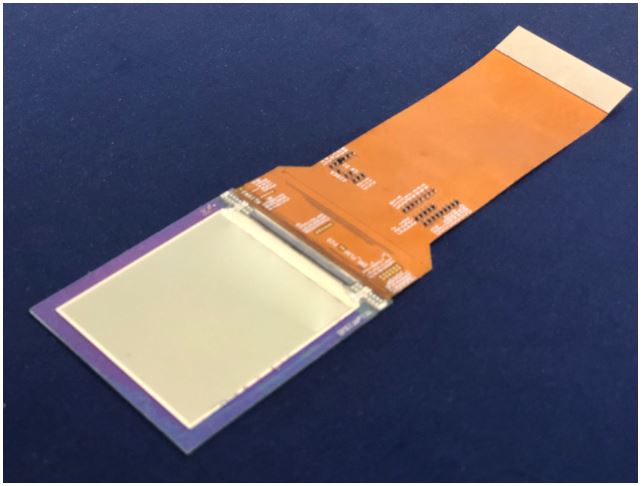

2.17-inch 2,228-ppi AMOLED display module from INT Tech. (Image: INT Tech)

OLED microdisplays also have very high pixel density, but they are built on more expensive silicon wafers and the maximum screen size is very small at less than 1 inch, said Sun. “Even though it has very high pixel density, it cannot be used for VR because it is too small and the FOV is very limited. We can make 3- or 3.5-inch displays for the VR system, providing a larger FOV while reducing costs.”

Another competitive technology is microLED displays, said Sun. There is a lot of discussion about this technology, but there is still no commercialization because of problems with improving yield in the mass transfer technology, she added.

INT would like to enter into more value-added and demanding applications, including robotics, medical, and military. “Our Smart Pixel and IC technology platform lets us develop the sensors on the glass — on the same backplane as the display — so we can put sensors anywhere on the whole display area,” said Sun. “It opens up new opportunities based on the integration, cost savings, and space savings. You can place it anywhere on the display and the cost is very low.”

“There are other merits,” said Chu. “Once you integrate all of these different functions on the backplane, you naturally reduce the thickness of the device. In order to reach a true foldable cellphone, you need to thin down the thickness first, and this technology will enable you to do this, so there are benefits beyond cost reduction and space utilization.”

INT’s O’flex technology (Origami Flexible Electronics) frees up displays and sensors from rigid form factors and offers better user experience, said Sun. “This is in addition to UHPD enabling next-generation VR/AR apps and Smart Pixel and IC that enables the development of multiple sensors on a glass substrate and the integration of sensors in the display area.”

“We choose these technologies because we see them as key technologies for the 5G era,” said Sun. “For 5G, we focus on AR/VR, which will be very popular because of the very high transmission speed, so when demand goes up, there will be demand for UHPD technology over the next 10 to 20 years. Also, in the 5G era, the IoT will become very popular and will need a lot of and all kinds of sensors, and everything will become foldable and flexible in the future. There will be foldable and flexible displays with integrated sensors for wearables, automotive, and biomedical.”

“Health-care monitoring is one area where we can contribute,” said Chu. “If you combine UHPD capability with O’flex, it can be like a flexible biometric sensor with a much bigger sensing area that will enhance the accuracy of the signal. Today, most of these sensors are made on a silicon chip, provide a small sensing area, and don’t stick to your skin. With flexible technology, it’s more like a skin sensor, so it offers much more reliable data.”

“There are challenges, such as how do you make an organic LED, and we’re working on that on the horizon,” said Chu.

Business model

But INT doesn’t operate like most display technology companies. Chu, a veteran in the display industry, who founded INT in 2016 after serving as CEO of EDO, a $1.1 billion AMOLED business, explained that INT’s go-to-market strategy is based on a collaborative development model through joint ventures and joint development programs that gives partners access to the company’s core knowledge and technologies to help them succeed.

One example is its partnership with UltraChip, which yielded a joint venture in 2017 called UltraDisplay, an AMOLED driver IC design house. The company is already selling the driver IC in the supply chain to major AMOLED manufacturers. UltraChip is the major stakeholder and is responsible for the joint venture, while INT provides the IP to the company.

INT has a very flexible business model and can work with customers in a number of ways, which includes joint development consulting services as well, said Sun.

Chu is very focused on developing next-generation display technologies. “I felt that going forward, we ought to be competing on a knowledge-based instead of scale-based economy. Forty years ago, when Taiwan emerged as one of the Four Asian Dragons, it took advantage of the growing young population back then. Now, it no longer possesses those advantages, so it’s good timing to try a knowledge-based economy, which is focused on innovation and my passion of working on the technology.”

INT stands for innovation and transformation, explained Ling. “We have a very rich IP portfolio, and our core competence enables our partners to compete in the market.”

INT is working with a lot of VR and AR companies in joint development projects through its lab, said Sun. “Starting next year, we want to transfer our lab into a microfab for a little more capacity so we can offer more samples to our customers.”

The company’s business model is to move from the lab into a microfab (as an extension of its lab) next year to provide customized design and sampling followed by mass production (via mega projects) in 2021 to 2023 through collaboration with partner relationships.

Advertisement