By Rian Whitton, Senior Analyst, ABI Research

For many segments of the robotics market, 2019 was a challenging year. Major industrial robot vendors posted poor financial results due to the slowdown in demand from their main markets in China and Europe. With the signing of the Phase 1 trade deal between the U.S. and China (which still leaves significant tariffs on the latter in place) and the recent ratification of the USMCA trade agreement in the U.S. Senate, it can be expected that 2020 will see companies suffer less from anxiety about the global trade environment along with a likely uptick in capital investment.

But while 2019 was a particularly painful year for industrial robotics players, their relative influence on the robotics industry has been waning for years. In more contemporary fields like collaborative robotics, new players have taken all the market share. Most notably, Universal Robots, owned by Teradyne, has outcompeted legacy vendors with a streamlined platform that prioritizes simplicity and ease of use.

But it is in mobile robotics where the industry is growing fastest. Whilst Universal Robots grew by 6% in 2019, Teradyne’s other major robotics acquisition, Mobile Industrial Robots (MIR), reached over $40 million in 2019, with 43% growth on 2018. Meanwhile, Amazon has deployed over 200,000 automated guided vehicles (AGVs) across its fulfilment and distribution network since 2012.

There was increased private sector funding in mobile robotics and autonomous cars, while the number of autonomous mobile robots (AMRs) deployed outside of traditional logistics and manufacturing locations also accelerated. Barring significant downturns in the global economy, 2020 is set to be the year when mobile robotics expand across a wider variety of commercial environments.

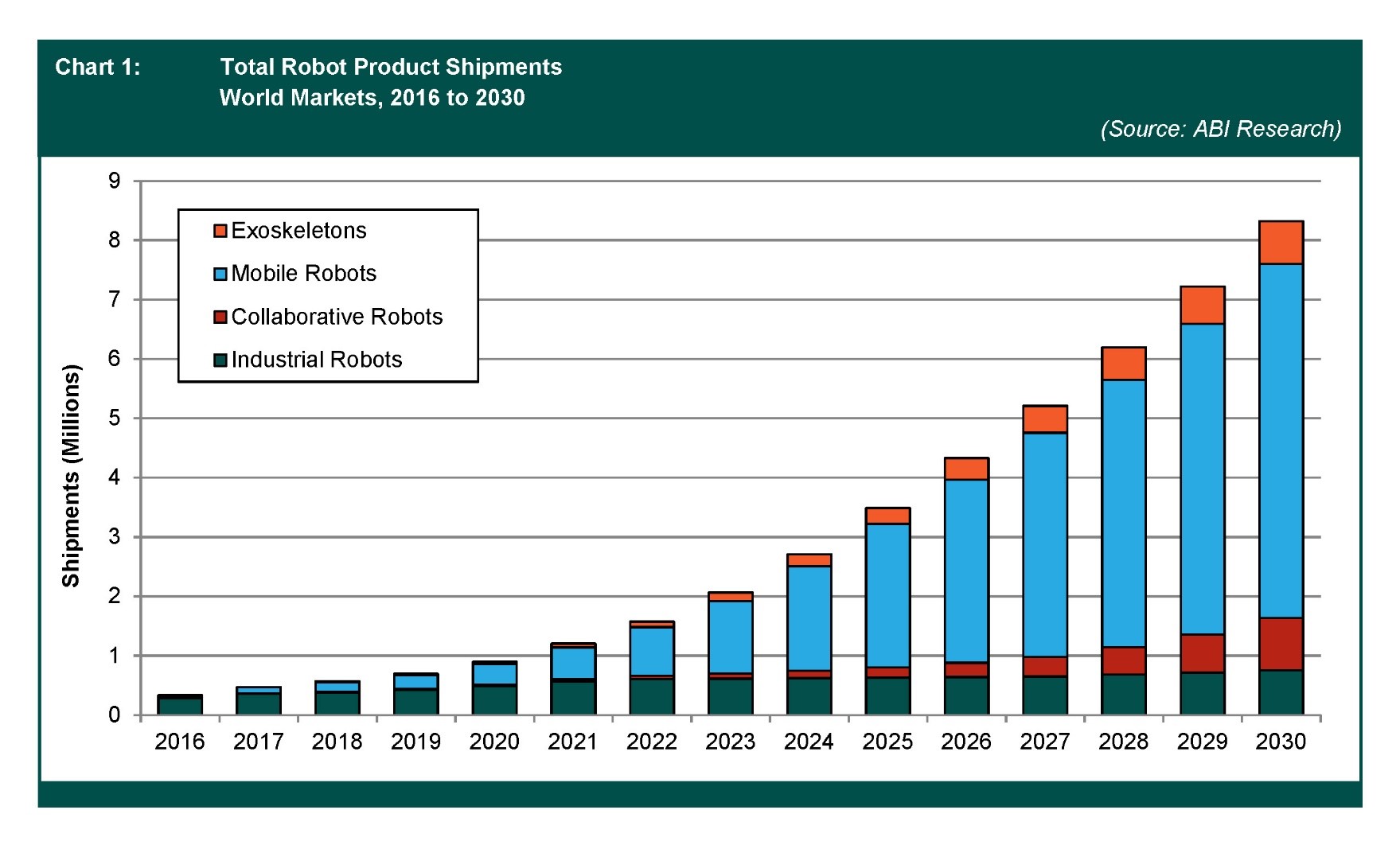

As shown in Chart 1, the shipments of mobile robots relative to traditional industrial systems is projected to grow massively in the next 10 years. The scale of growth stands out as well, with all products for the commercial robotics industry increasing from under $30 billion in 2020 to $276 billion in 2030. The vast majority of this growth will be attributable to autonomous mobile systems and to nascent markets like collaborative robotic arms and exoskeletons.

New verticals

It is well known that for mobile robotics, material-handling applications in warehouse fulfilment and manufacturing will be a huge market. First-mile intralogistics is a major area of the supply chain in significant need of productivity improvements, and companies like Amazon have already deployed hundreds of thousands of AGVs.

But what verticals outside of these highly structured and closed environments will see mobile robots deployed at scale? There are thousands of AGVs and AMRs deployed in hospitals for material handling, and there has been a tentative rollout of heavier robotic vehicles in construction, agriculture, mining, and other heavy outdoor industries.

Brick and mortar (B&M) retail could well be the prime testing ground for the scaling up of mobile unmanned fleets. There are already thousands of robots used to clean floors and hundreds have been deployed for security and inventory. More startups, like Coalescent Mobile Robotics in Denmark, are looking to add small-scale material handling to public spaces. This will create a demand for superior fleet-management tools that can manage mixed fleets from different vendors.

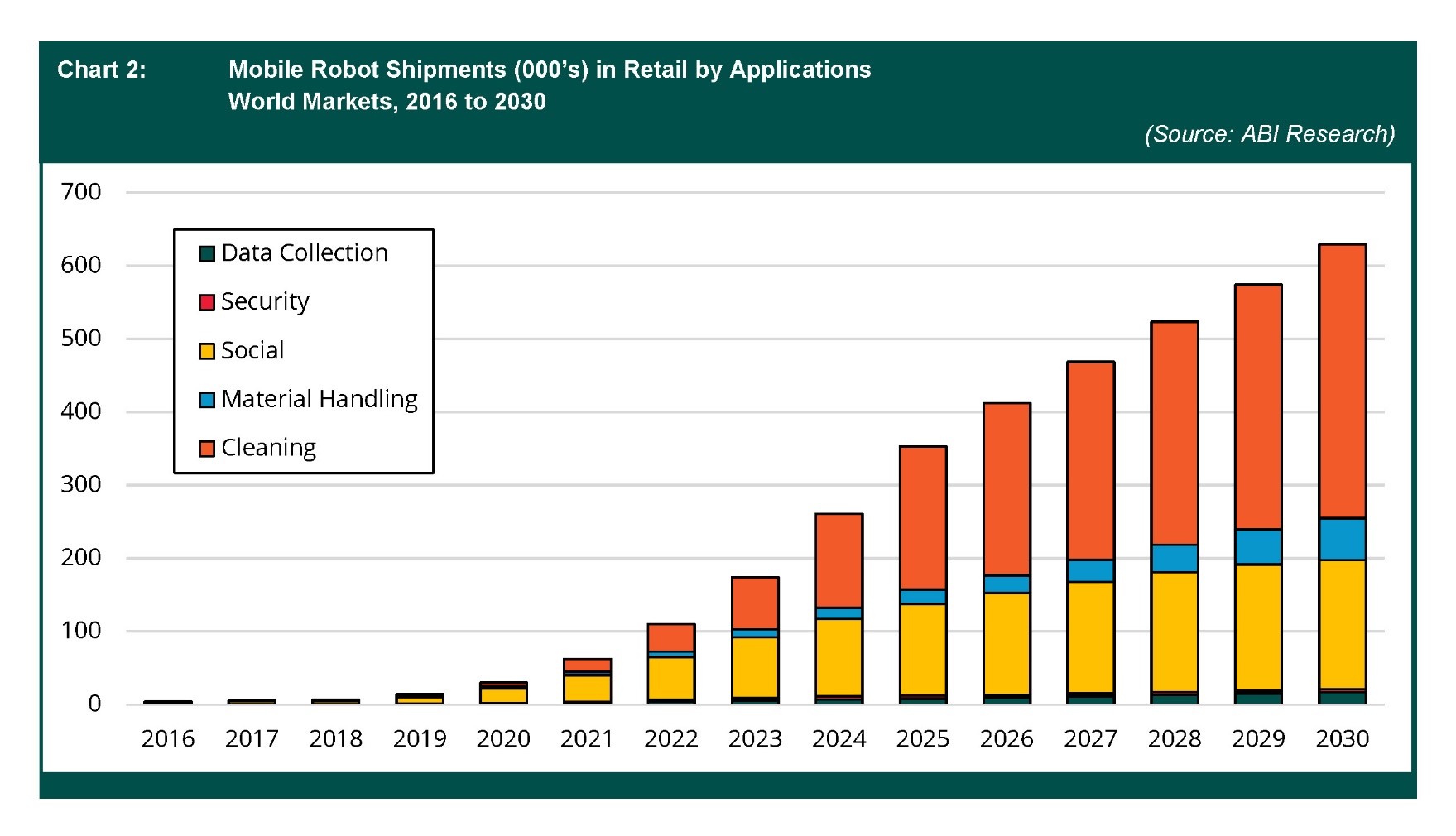

As shown in Chart 2, the largest application for robotics in retail will be cleaning and maintenance. There are already 5,000 cleaning robots in retail stores in North America, and this number will grow substantially. Tuggers and pallet stackers used in storage facilities will also proliferate, while the use of social robots will continue to grow, especially in East Asia. Brain Corp, the main developer of autonomous sweepers, has posted 760% growth in shipments in 2019 and 300% growth in revenue.

While limited in pure shipments, data-collection robots for inventory could be a hugely significant part of the market going forward. There is a huge amount wasted by B&M vendors in low stocks and stock-outs, with some estimating a yearly waste of $1 trillion. With mobile robots, companies can analyze shelves, develop ideal planograms for future demand, and preempt low stock to avoid shortages.

Exactly how companies use robots for inventory will vary. Pensa Systems uses drones to collect information and is deployed in over 100 locations worldwide. Bossa Nova Robotics and Simbe Robotics, meanwhile, are deploying larger and more durable mobile ground robots, with Bossa Nova deploying 350 in Walmart stores and planning to scale to 1,000.

ABI Research predicts that shipments for inventory ground robots in retail will be at over 1,000 globally by the end of 2020. In itself, this is small, but with more deployments comes greater ease of use, and B&M stakeholders realize the importance of having visual intelligence of their stocks to the point that they are increasingly willing to invest in robotics.

Quadrupeds to make a breakthrough?

Up until now, the success of quadruped robots has primarily been their marketing value as exciting pieces of futuristic hardware, as opposed to anything approaching day-to-day business value. While Boston Dynamics’ desire to commercialize its Spot Mini for verticals like construction and delivery has been clear for some time, we are far from anything beyond testing.

Two key challenges are technical redundancy and cost. For the latter, British developer Zoa Robotics believes it can market a quadruped with an annual cost well below $45,000. This would be a significant price drop from the hundreds of thousands of dollars these systems have traditionally cost.

There is a big opportunity in the oil and gas space as large companies try to automate visual inspections of their assets, and while ground-based systems will be vital to that, drones will be complimentary. The business case is certainly there. According to the Pipeline and Hazardous Materials Safety Administration (PHMSA), $24 billion is lost annually in downtime and accidents across the liquified natural gas (LNG) sector, and cost reductions from automating the visual inspection part of maintenance could alleviate maintenance expenditure. Tens of billions of dollars are spent on inspection for oil and gas each year, and a large proportion of that is visual inspections, with billions of dollars’ worth of value in automating the process with mobile robots.

More quadrupeds will be piloted in 2020, with some being certified by important regulations for operating in dangerous locations, such as the European ATEX Directive. Advocates argue that cheaper and more reliable quadrupeds could become much more common in the service robotics space, as the flexibility and adaptability of the form factor give it advantages over wheeled robotics.

For this to be considered feasible, 2020 should be the year when quadrupeds shift their value from marketing and technology demonstrations to improvements in productivity for businesses.

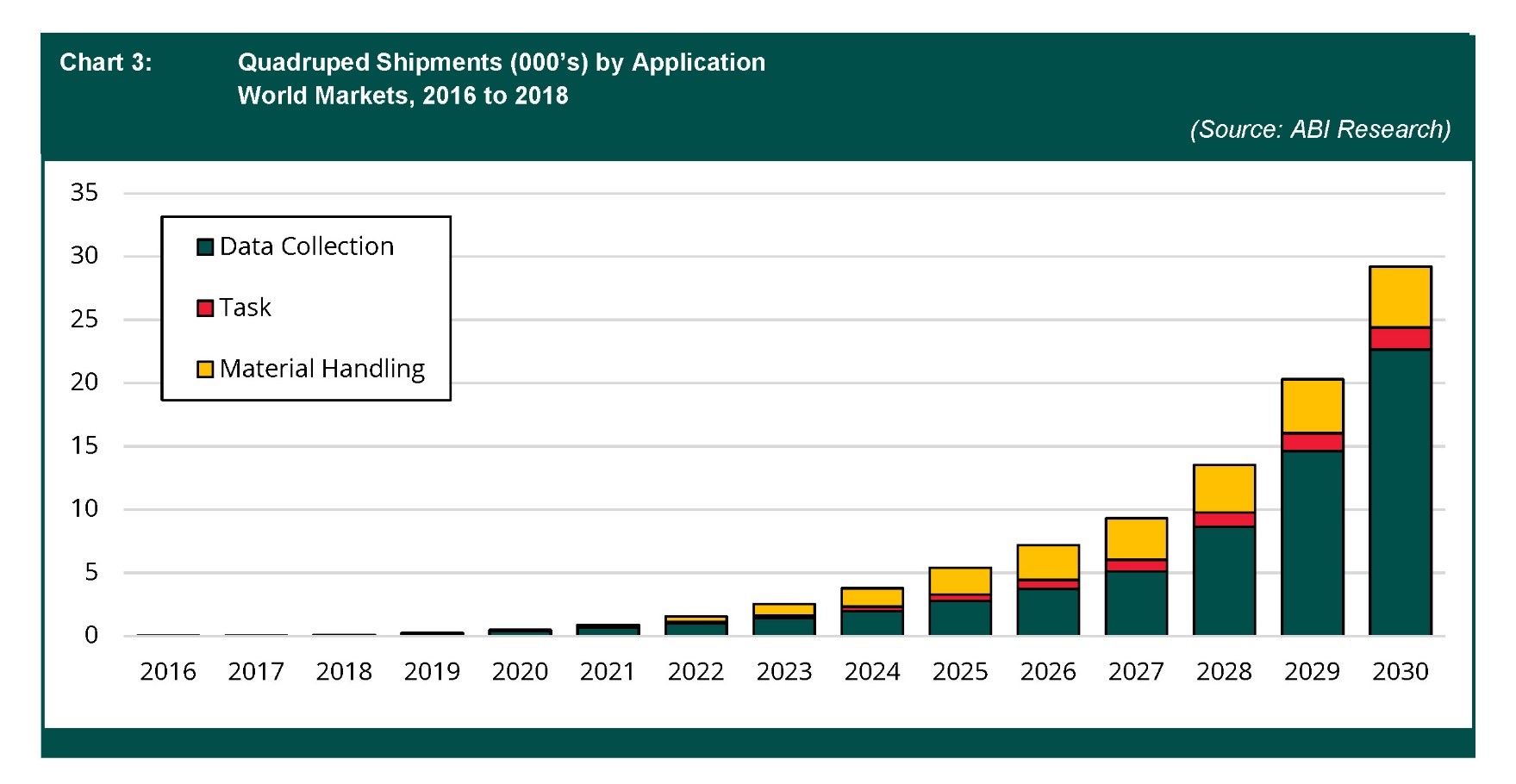

As shown in Chart 3, the big value for quadrupeds is in data collection. In this application, they are better than drones thanks to their form factor and payload to host expensive gas sensors and sophisticated cameras, all while processing large amounts of data and having battery lives of four to eight hours (compared to 30 minutes for most drones). They are also more valuable for task-based use cases, as they can be tele-operated to push buttons and used for material handling, while drones are limited by their form factor and weight.

Ultimately, 2020 will remain a year in which quadrupeds remain largely on the periphery of actual mobile robotic deployments and, while they can expect long-term adoption in applications like industrial inspection, it will take longer to determine if these systems become popularized in other verticals.

Growth drivers

What is driving growth? For collaborative robots, or cobots, there is growing appeal for easily controllable and redeployable articulated arms that have very few deployment costs and have an intuitive controlling system. The legacy industrial vendors have tried to build cobots but have generally failed to market them, as they apply the same programming to a smaller robot with no benefits to ease of use. Cobot providers like Universal Robots have fared better, and startups are beginning to develop collaborative systems with greater reach, payload, speed, cost, efficiency, and superior control software to provide incremental automation to a growing number of small- and medium-sized manufacturers who have so far been shut out of robot-led automation.

For mobile robotics, the trends leading to enormous growth are varied but can be segmented into three main categories:

- The self-driving technology dividend. AGVs have been deployed for some time. Thanks to the DARPA self-driving challenges with massive venture-capital funding in self-driving cars and pet projects from both Silicon Valley giants and auto suppliers, autonomous mobility has become popularized. The work so far has not led to driverless passenger vehicles, and this use case will not be realized in the short term. Instead, the depreciation in the cost of sensors and subsequent innovations in machine vision and processing power have made infrastructure-free movement possible for most vehicles that do not operate on the road.

- Amazon and e-commerce. With its ever-expanding reach and huge growth in delivering larger quantities of more varied products to different parts of the world, Amazon has been able to invest in tens of billions of dollars worth of new infrastructure. While previous AGV deployments were primarily a case of applying new technology at legacy facilities, Amazon has a clean slate to deploy 200,000 AGVs in tailor-made distribution centers. Amazon is not the only player in this e-commerce opportunity. British Ocado, Chinese Alibaba and JD.Com, and Japanese Rakuten are all examples of new businesses with high capital expenditures that are deploying tested mobile solutions at scale.

- Retrofitting opportunities. The technology behind autonomous navigation has moved beyond experimentation. Improved LiDAR, machine vision, and processing power are supplemented with advanced odometry, simultaneous localization and mapping (SLAM) software, and mobile telepresence. Some companies see an opportunity and are using a mix of sensors, a professionalized robot operating system (ROS), and other operating systems (OS) to offer autonomous navigation in a range of vehicles. Among these companies is BlueBotics: Its ANT navigation helps automate different industrial and commercial vehicles, and the company has deployed 2,000 robots.

Some industry watchers think there is an opportunity for a sensor and software provider to have a totally agnostic navigation platform or, in a sense, being the Google Android for mobile robotics. This aspiration is very speculative at present, given the immense complexity and variety of vehicles relative to devices. However, cross-vehicle applications and navigation are certainly lowering barriers to different suppliers and are allowing mobile robots to scale.

Conclusion

The last five years of increasing private sector and public investment into mobile robotics companies has seen greater diversification regarding sensor configurations, applications, and market use cases, but adoption has been monopolized by the use of AGVs for material handling in structured environments, as showcased by Amazon.

The robot industry is, therefore, characterized by a near-endless variety of products, devices, and systems, but only a relatively small number of companies have achieved sufficient scale to deserve the hype. While material handling and providing innovation to the supply chain remains the single-greatest appeal of mobile robotics, onlookers can expect thousands of systems to hit health care, retail, restaurants, outdoor field operations, and many other locations in 2020. This has been made possible by improved navigation and perception, trial and error, and increasing demand from end users who cannot access the requisite labor.

Advertisement